Confidence, Market Valuations, and One of My Favorite Columnists

Lots happening in the markets, working with clients, and living life.

Resuming my weekly summary of events in the economy, markets, and specialty areas of interest.

And, we are never too busy to answer questions. Please keep them coming in, via our contact form here, https://www.stantongwp.com/contact , or for a 15 minute phone call, you can schedule here. https://calendly.com/jstanton-1/strategy-call

Enjoy, and look forward to speaking with everyone soon!

Economy

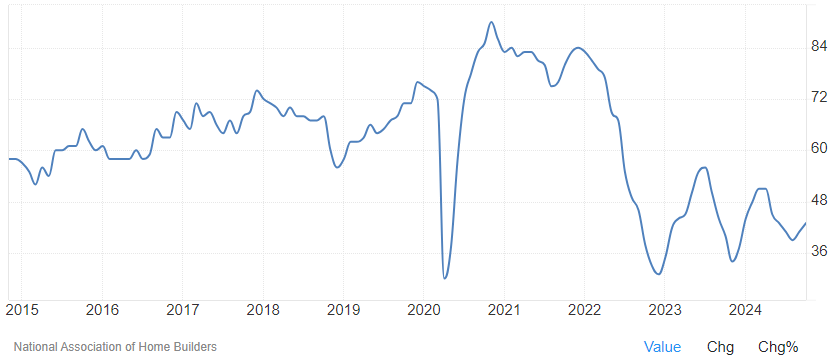

Builder Confidence

National Association of Home Builders (NAHB) rose two points for the second consecutive month in October. Still remains below the threshold of 50, indicating continued lackluster confidence about current, and near term outlook.

Employed Part-Time for Economic Reasons

Fewer job openings directly affect individuals looking for full-time work. As a result, many are being forced to accept part-time jobs instead. The number of individuals who are Employed Part-Time for Economic Reasons is a measure that comes from the Employment Situation Summary Report and includes employees who cannot find full-time work, face reduced hours, or see seasonal declines in employment.

4.6 million individuals is the latest count in September, up from 4.1 million a year earlier. This labor underutilization is a concerning trend, and if it continues, it could signal bigger problems ahead.

Source: Employment Situation Summary Report, BLS

Stocks and Indexes

The S&P 500 Closed Lower Last Week

After another quiet week of macro economic data releases, and mixed earnings announcements, the S&P 500 closed down 1% for the week.

Weighted vs Market Cap Weighted

S&P 500 Market Cap Weighted YTD 23.07%

S&P 500 Equal Weight YTD 13.55%

As of October 28, 2024

Bonds

Yields increased slightly, closing at 4.25% on the 10 year Treasury.

January 2024 10 Year Yield 3.946%

Gold

The price of gold increased to $2,760.80 a troy ounce.

Up 33.83% YTD.

TECHNICAL and FUNDAMENTAL UPDATE

Technical

The technical indicator showing a lack of selling on up market days, continued its decrease. This indicator, along with downside breadth, are what we continue to watch to see if this bull market can continue.

Fundamentals

The Buffett Indicator

“A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.” – Warren Buffett

The Stock Market Capitalization-to-GDP ratio, often referred to as the Buffett Indicator, serves as a crucial measure of whether stock prices align with economic fundamentals. Buffett himself has has said this ratio as the “best single measure” of valuation at any given time. A ratio above 1.0 signals overvaluation.

Today, this ratio sits at a mind boggling 1.97, up from 1.8 in April and one of the highest readings in history!

This means that the stock market is trading at twice the level of the economy’s total output, a clear indication that prices are detached from economic reality.

There are many other measures of stock market valuation, and all are pointing towards an expensive market.

The bottom line, regardless of whether you are betting on a soft landing, or hard landing, for the economy, being aware of the elevated risk, will be the key to navigating the investment environment over the next few years, and your performance over the next decade.

One of My Favorite Columnists

Growing up in a neighborhood on the Northwest Side of Chicago, one of the ways we earned some spending money was through a paper route.

I guess you could say that the newspaper business was in my blood. Both my Grandfather Les Stanton, and Uncle, Paul Stanton, were in Advertising Sales for Newspapers. Les spent his entire career with the Bay City Times, in Bay City Michigan. Paul was with a number of news organizations throughout his career, that took him to Saginaw and Muskegon MI, NY, Lawrence Kansas, Colorado, and Louisanna.

My first paper route was a weekly neighborhood paper when I was 10. At 12, a route opened up with the Chicago Tribune, which I expanded, and kept going, with my brothers help, through my Junior year of HS.

My reading of the paper started with the sports section, scanned the headlines, then business, and the comics. A young journalist by the name of John Kass joined The Paper back in 1980, and caught my attention. His writing covered a broad range of topics, including politics, crime, and corruption in Chicago, along with his families stories, and Greek culture.

I continue to read his columns, now found at John Kass News. https://johnkassnews.com/

Here, he writes something every day, from a few paragraphs, to a full column, on the same topics he wrote about at the Tribune.

He also has guest writers, and a podcast called "The Chicago Way", for additional content that is informative, and enjoyable.

One of his guest columnists, James Banakis, a life long restaurateur, wrote of column last week that I felt, is particularly insightful today.

He focused on one of the our cherished American values, and rights, the liberal value of Freedom of Speech.

You can find it here, if you would like to read. https://johnkassnews.com/the-indispensable-man-the-indispensable-right/

Have a great week!

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, and through SeaCrest Wealth Management, LLC, serves as the Registered Investment Advisor Representative for clients, focusing on financial planning and the investment strategies to support their financial plan.

Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

Learn more about John’s services by visiting www.stantongwp.com

John can be reached at l 630-445-2380 or email JStanton@seacrestwm.com.

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (the “SWM”) a registered investment advisor. SWM is a registered investment advisor (“RIA”), with the U.S. Securities and Exchange Commission located in the State of New York. SeaCrest Wealth Management, LLC can be reached at (914) 502-1900.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of John Stanton, and should not be regarded as the views of SeaCrest Wealth Management, LLC, or its respective affiliates or as a description of advisory services provided by SeaCrest Wealth Management, LLC, or performance returns of any SeaCrest Wealth Management client.

The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned.

Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.