Portfolio Risk Management Not Market Timing: Why its Important to Understand the Difference Now

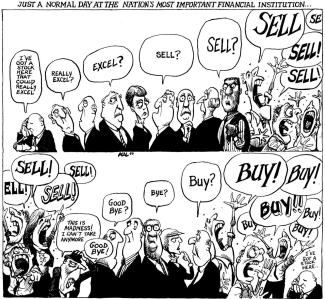

After last weeks market sell off, we are seeing many, many stories and posts on why this occurred, and what you should do now.

Here are a few examples.

"Stocks Are Crashing—That’s a Great Reason to Sit Tight"

The sudden selloff in Japanese equities and a surge in the VIX suggest the current rout is being exaggerated by trend chasers. WSJ, August 5, 2024

https://www.wsj.com/finance/stocks/stocks-are-crashingthats-a-great-reason-to-sit-tight-c48e5dee

"The Slowdown Scenario"

David Kelly, Chief Global Strategist at J.P. Morgan Asset Management, August 5, 2024

"Don’t Panic: It’s Not 2022 All Over Again"

David Sekera, CFA, Chief US Market Strategist for Morningstar

Our Take: Portfolio Management Based On Market Risk

There are many indicators that can be used, to assess where the overall market is, in terms of riskiness.

Large Bear Market drawdowns, although far apart, can be devastating to an overall financial plan, especially in the years leading up to, and in, retirement.

Why? Because bear market losses can take longer to recover from, than the financial pundits have you believe. And, if you are drawing from retirement accounts that are down, the potential for drawing down , and running out of retirement money, increases. See here on a previous post on Retirement Income Planning https://www.stantongwp.com/blog/what-your-retirement-income-plan

By using a weight of evidence approach, we have developed a risk management methodology to stock portfolio management, decreasing exposure to the market , when the market is at its riskiest for more than a correction.

Conversely, these same indicators can be used to show us when the market is presenting the best opportunity to increase exposure to a more fully allocated stock position. See here, previous post on indicators used. https://www.stantongwp.com/blog/what-we-were-reading-and-watching-week-7

The Economy and the Markets Now

A number of reports on the economy came in last week, pointing towards increasing odds of a "hard landing".

Employment Statistics

The Job Openings and Labor Turnover Report (JOLTS) fell again, and are now below where they were prior to the pandemic.

The quits rate has fallen throughout this year, and is now back to the levels seen in 2018.

These signal that the labor market is likely cooling faster than anticipated.

Confirming news came in Fridays Jobs report from the Bureau of Labor Statistics, with only 114 thousand new jobs, a decrease from last month’s downwardly revised 179K.

The labor market continues to cool.

Stock Market

An index of AI stocks is down 13.4% from its high, and continues to drop, the selloff in these, and other tech continues.

The lack of selling on up market days remains weak, while distribution measure on down market days is neutral. This second indicator appears to be increasing at a rapid rate, which could require additional defensive positioning of a portfolio.

Based on the weight of evidence, our practice continues to maintain a defensive positioning of stock portfolios.

What to Do Now

Plan First

We believe strongly that investment strategy should be coupled with prudent financial planning. A comprehensive plan, based on personal lifestyle goals, is always the first step. As a practice dedicated to working together with our clients, we offer consultation in a number of financial areas, serving as a coordinator with other professionals, to ensure your plan is implemented in a professional, timely manner.

How We Are Positioned

Our practice has 5 model portfolio, to guide us in constructing individual portfolios for our clients, based on a comprehensive financial plan, goals, objectives, risk tolerance, and time horizon.

Here is the big picture positioning of each.

Capital Appreciation

Objective: Growth, Long Term Time Horizon, Moderate Tolerance for Risk

Growth, Select Dividend Stocks, Market Exposure 55%

Short Hedge 0%

Treasury Bill Money Market 45%

Value and Dividend

Objective: Growth, Income, Long Term Time Horizon 10 years plus, Moderate Tolerance for Risk

Select Dividend Stocks, Market Exposure 55%

Short Hedge 0%

Treasury Bill Money Market 45%

Balanced

Objective: Balance of Growth and Income, Long Term Time Horizon 10 years plus, Moderate Tolerance for Risk.

Select Dividend Stocks, Market Exposure 27%

Short Hedge 0%

Treasury Bill Money Market 21%

Fixed Income 47.0%

Select Real Estate Investment Trusts 5%

Moderate Fixed Income

Objective: Income, Medium to Long Term Time Horizon, Moderate Tolerance for Risk

CDs, Treasuries, Corporate, Municipal Bonds, Laddered 65%

Select Preferred Shares 30%

Treasury Money Market, cash 5%

Conservative Fixed Income

Objective: Income, Medium to Long Term Time Horizon, Low Tolerance for Risk

95% Laddered Portfolio of CDs, Treasuries, Municipal Bonds, and Investment Grade Corporates.

5% Treasury Money Market

Please schedule a 15 minute call to review historical and detailed current positioning using our Core & Protect Risk Management Process, our research, and our model portfolios.

https://calendly.com/jstanton-1/stanton-group-introduction-with-john-stanton

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, and through SeaCrest Wealth Management, LLC, serves as the Registered Investment Advisor Representative for clients, focusing on financial planning and the investment strategies to support their financial plan.

Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

Learn more about John’s services by visiting www.stantongwp.com

John can be reached at l 630-445-2380 or email JStanton@seacrestwm.com.

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (“SWM”) a registered investment advisor.

The Advisor provides investment advisory and related services for clients nationally. The Advisor will maintain all applicable registration and licenses as required by the various states in which the Advisor conducts business, as applicable. The Advisor renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of John Stanton, and should not be regarded as the views of SeaCrest Wealth Management, LLC, or its respective affiliates or as a description of advisory services provided by SeaCrest Wealth Management, LLC, or performance returns of any SeaCrest Wealth Management client.

The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned.

Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.