Small Businesses, Market Technicals, and the New Year

Economy

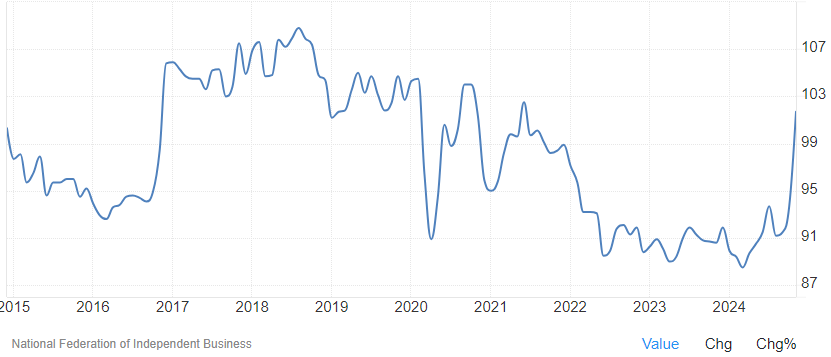

Small Business Optimism, Confidence

Small to medium businesses, defined as privately held enterprises employing 500 or fewer, are an important part of our national economy.

These businesses employ over 50% of our workforce, and are responsible for 55% of net new jobs, over the past 10 years.

The latest Small Business Optimism Index from the National Federation of Independent Businesses (NFIB) surged eight points in November, to 101.7, its highest reading since June 2021. Nine of the ten subcomponents increased and for the first time in nearly three years, the Index surpassed its 50-year average of 98.0.

November’s sharp increase can be attributed to the Presidential Election results, which signals a major shift in economic policy. This anticipation of economic growth is driven by pro-business policy under the new administration that includes deregulation, tax reforms, and support for domestic energy production.

The November NFIB report showed that the Single Most Important Problem remains inflation, which continues to be stubbornly above the Federal Reserve’s 2% target.

Optimism and confidence, among businesses and consumers, is a starting point to a vibrant, productive economy. However, there are many structural issues that will effect the economy going forward. Will be going into a detailed assessment as part of our client 2024 review, and outlook, available the third week of January.

Stocks and Indexes

The S&P 500 Closed the Year on a Down Note

After a euphoric end of year really, the S&P 500 closed the year off 3% the last 4 trading days of the year.

Final 2024 Market Numbers

Weighted vs Market Cap Weighted

S&P 500 Market Cap Weighted YTD 24.98%

S&P 500 Equal Weight YTD 12.78%

As of December 31, 2024

Bonds

Yields finished the year at 4.58% on the 10 year Treasury, up from the year low of 3.63% in September.

January 2024 10 Year Yield 3.946%

Gold

The price of gold finished the year at $ 2,609.10 a troy ounce.

Up 27% for 2024.

TECHNICAL and FUNDAMENTAL UPDATE

Technical

Downside Distribution

After not moving for 24 months, downside distribution appeared December 20th, and continued to accelerate into the year end.

What is Distribution?

This indicator measures the rate of acceleration in downside leadership. By looking at the rate of acceleration in downside leadership, this shows that investors have reached a stage of selling, and are anxious to sell stocks, even at a big loss.

It is a measure that gets my attention, and is when bear markets can start.

Last time this appeared, along with a measure that shows selling even into up markets, was early January 2022.

Our models with Stock Exposure continue to be 60% net long, in high quality defensive names, and will continue to monitor , and make any additional defensive moves, based on the technical and fundamental weight of evidence.

Fundamentals

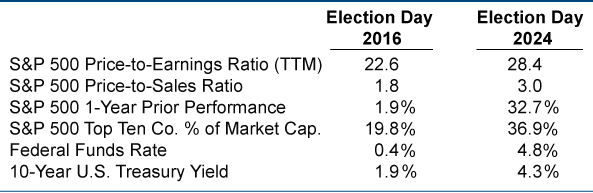

S&P 500 Valuation

The market environment today is significantly more stretched than it was in 2016 which is another investors have to monitor when making investment decisions.

This includes valuation concentration and higher interest rates. Valuations are meaningfully higher than in 2016, especially the Price-to-Earnings and Price-to-Sales ratios (see table below). In addition, interest rates today are vastly elevated.

Y2K New Year Celebration 2000

We spent New Years Eve with a group of close friends, sharing good food, drink, music, and conversation.

A very enjoyable evening!

Watching the count down, and the celebrations, fireworks, had me remembering a New Years celebration 25 years ago, 1999.

We needed a sitter to go out, our two boys were 5 and 6 at the time, (2000 was a terrific year, our daughter was born in December, very blessed with 3 great kids!). My Uncle, and parents, volunteered for the job. Come to think of it, they were always available, and a great help, when Jill and I wanted to get away for a date night.

Our plans were to go to a party with a close couple friend of ours. Dinner, cocktails, live music, we partied into the night! When the clock struck midnight, enjoyed fireworks, then finished the evening with nightcaps in the lounge.

At the time, I was working as part of the executive team with a small local investment manager.

All year long, our IT people were preparing, and testing, for the expected problem that Y2K was supposed to create.

Y2K was the "bug" of computer code in older programs that only had 2 places for the date. When the new year rolled over to 2000, the old computer code would see 00, possibly throwing off how programs/software functioned. Which, could have had a chaotic effect on the air traffic control, telecommunications, fuel delivery, logistics, utilities, defense, and of course, market and trading systems.

All department heads were required to come into the office, first thing in the morning on January 1, to run, and monitor, the various programs in our respective departments.

Working on a few hours sleep, we ran through all the systems, without any glitches.

The first week of 2000, we saw our investment management team take down the exposure to technology stocks in all the portfolios, after the tech led investment boom of the 90s caused an over concentration in this sector. (The S&P 500 had 40% of its exposure to Tech Stocks at the time).

This turned out to be a very good capital preservation move, as the 2.5 year bear market that began in March of 2000, saw the market fall by 50%, to bottom in October of 2002.

The lesson I took away, there is a time to be bullish, more fully invested, and a time to be cautious, protect capital.

Happy New Year everyone, look forward to speaking with you soon!

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, and through SeaCrest Wealth Management, LLC, serves as the Registered Investment Advisor Representative for clients, focusing on financial planning and the investment strategies to support their financial plan.

Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

Learn more about John’s services by visiting www.stantongwp.com

John can be reached at l 630-445-2380 or email JStanton@seacrestwm.com, or schedule a intro call at https://calendly.com/jstanton-1/stanton-group-introduction-with-john-stanton

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (the “SWM”) a registered investment advisor. SWM is a registered investment advisor (“RIA”), with the U.S. Securities and Exchange Commission located in the State of New York. SeaCrest Wealth Management, LLC can be reached at (914) 502-1900.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of John Stanton, and should not be regarded as the views of SeaCrest Wealth Management, LLC, or its respective affiliates or as a description of advisory services provided by SeaCrest Wealth Management, LLC, or performance returns of any SeaCrest Wealth Management client.

The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned.

Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.