Tariffs and Deficit Reduction: What These Mean for Your Retirement

As you near retirement, it’s natural to start focusing on your financial future, planning for a stable and comfortable life in those golden years. But the path to retirement isn’t just about saving money and investing wisely; it's also influenced by broader economic factors. Two such factors—tariffs and deficit reduction—can have a significant effect on your financial plans, especially if you’re five years away from retirement. Let’s break down what these terms mean and how they could affect you.

What Are Tariffs?

Tariffs are taxes or duties placed on imported goods. Governments impose them to protect domestic industries from foreign competition or to generate revenue. For example, if the U.S. places a tariff on Chinese steel, it raises the cost of imported steel, making domestic steel more attractive to buyers.

How Tariffs Impact Your Finances

The adjustment period of tariffs, during which the flow of global trade is rearranged, can have a ripple effect on the stock market. Trade wars and the uncertainty they bring can lead to volatility in financial markets, which can affect your retirement portfolio. If a large portion of your assets are in stocks or bonds linked to global trade, this volatility might cause concern.

For someone five years from retirement, or in retirement drawing off their portfolio, this stock market volatility may increase the chances of running out off money in retirement.

This recent interview with Treasury Secretary Scott Bessent, does a good job on laying out the rationale , and the outcomes they are looking to achieve, with the new administration's plans.

https://www.youtube.com/watch?v=CVa5MEnvShc

Deficit Reduction: What Is It and Why Does It Matter?

The national deficit refers to the amount by which government spending exceeds its revenue in a given year. Over time, if this deficit continues to grow, it can contribute to an overall national debt, which is the total amount the government owes. Deficit reduction is the process of reducing the national deficit by either cutting government spending, increasing taxes, or a combination of both.

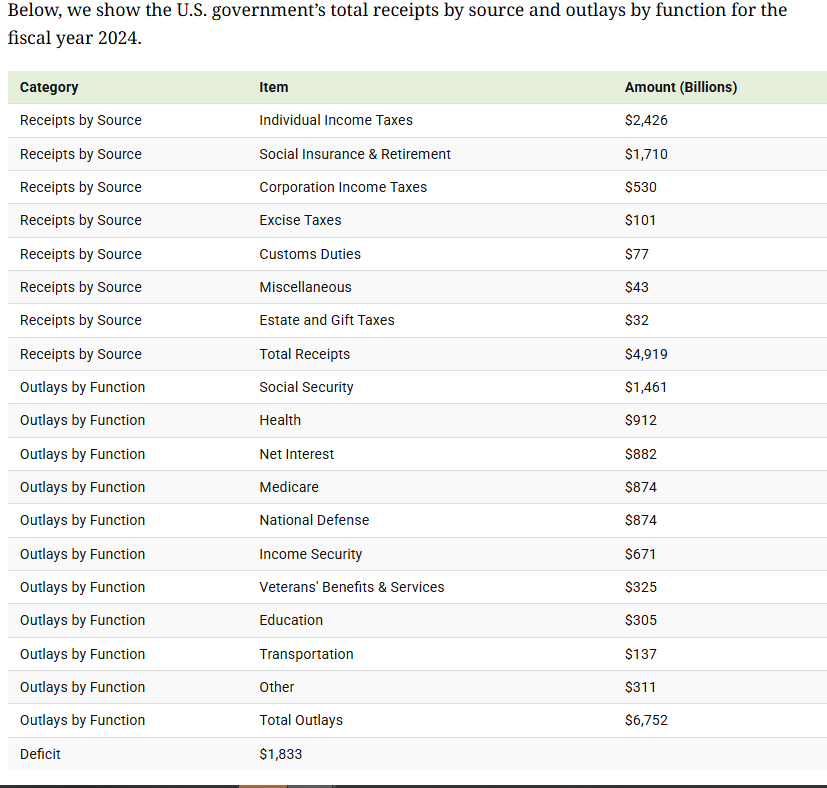

U.S. Tax Revenues and Budget Deficit: Both at New Records

Tax Revenues $4.92 Trillion 2024

Outlays $ 6.75 Trillion 2024

Deficit -$1.8 Trillion 2024

For the average U.S. citizen, deficit reduction might seem like a distant or abstract concept. However, the government's fiscal health directly impacts the dollar, interest rates, the markets, inflation, the job market, and social programs.

How Deficit Reduction Could Affect Your Retirement

As you approach retirement, deficit reduction can have both positive and negative impacts on your financial future. On one hand, if the government focuses on cutting unnecessary spending and balancing the budget, it could lead to a stronger, more stable economy. This might mean lower taxes and a healthier job market, which could benefit your investments in the long run.

On the other hand, if deficit reduction leads to cuts in government employment, the economy may suffer short term, with the impact on stocks and bonds possibly causing a shortfall in retirement income, or worse, running out of money when you need it the most.

It’s important to consider these potential risks when planning for retirement, as you may need to adjust your savings rate, explore additional sources of income, and develop risk management strategies.

This Happened Before, but It Is Different This Time

The biggest effort to overhaul the federal government in modern history actually was over 30 years ago under a Democrat administration. It was then-President Bill Clinton’s “ Reinventing Government ” initiative, under the control of his vice president, Al Gore.

Back then, the Clinton administration worked with Congress to authorize $25,000 buyouts for federal workers and ended up eliminating what were more than 400,000 federal positions between 1993 and 2000 through a combination of voluntary departures, attrition and a relatively small number of layoffs.

The Reinventing Government team also pushed the workforce to embrace a brand new technology — the internet. Many governmental web sites and programs, including the electronic filing of income taxes, date back to the Reinventing Government initiative.

On the tax side, the The administration also raised taxes, adding two new top brackets, of 36% and 40%, that kicked in at $143,600 in joint household income ($300,000 in todays dollars).

Balancing the Economic Equation

So, what happens when tariffs and deficit reduction intersect? It's possible that the government might impose tariffs to raise revenue while simultaneously pursuing deficit reduction measures. The result could be a complex mix of rising costs and potential cuts to social services. As a person nearing retirement, this creates uncertainty—especially since both tariffs and deficit reduction could affect the stock market and inflation.

Practical Steps for a Person 5 Years from Retirement

With these economic factors in mind, what steps can you take to protect your financial future? Here are some ideas:

- Develop a Comprehensive Retirement Plan: Develop a plan that includes your goals for spending, income sources, medical care, tax minimization, and your estate.

- Incorporate a Risk Management Process: Since tariffs and deficit reduction can lead to market volatility, having a sound plan to "step through" the large draw downs of a bear market, may help you conserve capital, even when taking withdrawals for income. In addition, diversifying sources of income, can produce a less stressful retirement.

- Monitor Inflation: Inflation can erode your purchasing power, which is especially concerning if you're on a fixed income after retirement. Reviewing your lifestyle spending, and looking at strategies where your income streams can grow over time, are Look for ways to hedge against inflation, such as investing in inflation-protected securities (like TIPS) or ensuring your income streams can grow over time.

- Reevaluate Your Retirement Savings Goals: With the potential for cuts to government programs, it may be wise to increase your savings rate in the next five years. If you're behind on your retirement savings, you may want to contribute more to your 401(k) or IRA to make up for any future shortfalls.

- Stay Informed: Stay on top of the economic landscape. Evaluate corporate results, economic numbers that matter, local business sentiment. By understanding what’s happening, you can make informed decisions and adjust your retirement strategy accordingly.

Conclusion

While tariffs and deficit reduction may seem like distant, abstract concepts, they can significantly affect your financial future—especially as you approach retirement. The key is to stay informed, plan ahead, and make sure your retirement strategy accounts for these broader economic trends. By taking proactive steps now, you can protect your wealth, ensure your financial security, and enter retirement with peace of mind.

Ultimately, while the economy can be unpredictable, having a strong, adaptable plan is the best way to prepare for whatever comes your way.

Schedule a 15 minute intro call with John, to review our "Core and Protect" risk management process, our 5 models, and how our strategies are positioned now.

https://calendly.com/jstanton-1/meeting-with-john-stanton

John Stanton

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, and through SeaCrest Wealth Management, LLC, serves as the Registered Investment Advisor Representative for clients, focusing on financial planning and the investment strategies to support their financial plan.

Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

Learn more about John’s services by visiting www.stantongwp.com

John can be reached at l 630-445-2380 or email JStanton@seacrestwm.com.

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (“SWM”) a registered investment advisor.

The Advisor provides investment advisory and related services for clients nationally. The Advisor will maintain all applicable registration and licenses as required by the various states in which the Advisor conducts business, as applicable. The Advisor renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion.

Insurance and annuities offered through Stanton Group Wealth Partners, IL Il Insurance License #17867818.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of John Stanton, and should not be regarded as the views of SeaCrest Wealth Management, LLC, or its respective affiliates or as a description of advisory services provided by SeaCrest Wealth Management, LLC, or performance returns of any SeaCrest Wealth Management client.

The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned.

Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.